Behind Beyoncé’s Record-Breaking Cowboy Carter Tour: An Accounting Perspective

- Nikki Winston, CPA

- Aug 4, 2025

- 9 min read

I’m Nikki Winston, CPA, and yes, accounting even applies to Beyoncé. I love showing how accounting shows up in the most exciting, unexpected corners of our lives. This post breaks down how taxes, tour revenue, sales reporting, and even the jock tax come into play when artists like Beyoncé go on tour. Whether you’re part of the BeyHive or just curious how live events really make money, this is a look behind the numbers and why they matter.

Beyoncé’s Cowboy Carter Tour is rewriting industry records. With five sold-out nights in Los Angeles grossing over $55 million and a six-night residency in London bringing in £45 million (~$61.5M), the tour has cemented her position as the highest-grossing Black touring artist of all time. By the time the final stop closed out in Las Vegas, career tour earnings for Beyoncé Knowles-Carter were expected to surpass $2 billion - a feat never before accomplished by a solo Black artist.

What the headlines don’t show is the discipline behind the dollars. Gross revenue draws attention, but true business success lies in understanding what remains after the lights go out. At The Winston CPA Group, we equip entrepreneurs and creatives with the tools to make sense of their money, plan strategically for taxable events, and be informed about their revenue, income, and cash flow.

Let’s walk through the Cowboy Carter Tour’s economics: what came in, what went out, and why Beyoncé’s structure continues to be one of the most strategically sound in entertainment today.

Cowboy Carter: The Tour That Made History

The Cowboy Carter Tour stands as the highest-grossing country tour of all time, and Beyoncé is the first Black woman to hold that title. The final gross exceeded $400 million across 32 cities, outpacing legacy country acts like George Strait, Garth Brooks, and Shania Twain. At the core of this business is Parkwood Entertainment, Beyoncé’s company, which acts as both the brand steward and the back-office operational hub for the tour.

Her team likely included:

A tour accountant

Business manager

Payroll administrators

Legal advisors

Logistics coordinators

And a fractional CFO equivalent overseeing cash flow, tax obligations, and spend tracking

Let’s break down how it works.

Tour Revenue Streams

Beyoncé’s tour income doesn’t come from ticket sales alone. These are the primary revenue categories:

Net Ticket Sales: $320M estimated (after promoter cuts and ticketing fees)

Sponsorships & Partnerships: ~$30M

Merchandise Sales: Estimated $50M

Total Revenue: ~$400M

She’s likely paid either through a revenue-sharing model or a guaranteed minimum from the promoter (such as Live Nation), which finances the tour, fronts production costs, and recoups its investment from ticket sales and concessions.

The Cowboy Carter Tour for Marketing & Brand Integration: Cécred + Sir Davis

Beyoncé’s business acumen was on full display throughout the Cowboy Carter Tour in how she structured her income streams and positioned her brands.

Cécred’s Strategic Stage Presence

Her Cécred haircare line appeared in behind-the-scenes content and was worn by dancers and stylists alike, organically showcasing the product in action. The brand was positioned not as an ad, but as an extension of Beyoncé's identity. This type of implicit brand storytelling is one of the most effective forms of marketing because it bypasses traditional advertising fatigue and meets the audience where they already revere the product: in Beyoncé’s world. From the meticulous choreography that highlighted natural textures to the subtle inclusion of Cécred backstage, the tour became a living, breathing ad campaign with visibility across international markets.

The Sir Davis Lifestyle

At select Cowboy Carter shows, Beyoncé was handed a glass of Sir Davis, her premium cognac, by a choreographed robot - a deliberate and striking moment of brand integration. Sir Davis, produced under her ownership, was featured during the performance in a way that doubled as real-time advertising. It positioned Sir Davis as part of the Cowboy Carter experience, reinforcing Beyoncé’s ability to monetize moments and command attention across industries and continents.

While it may appear effortless on stage, featuring Cécred and Sir Davis typically involve dedicated marketing budgets, whether through internal allocations at Parkwood or cost-sharing with production. From a business perspective, Beyoncé is positioning her lifestyle brands in a way that commands global attention and maximizing visibility without relying on traditional ad spend. In-kind placements like these create brand association, drive consumer curiosity, and convert live performance into a luxury lifestyle showcase - and revenue.

Cowboy Carter by the Numbers: What It Costs to Make History

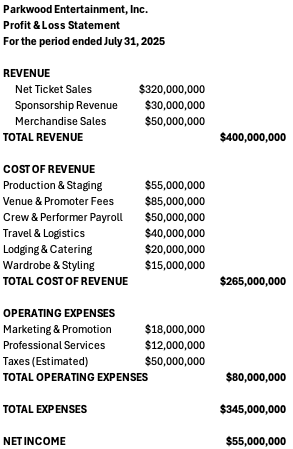

Behind the glitz is a complex financial structure. Here’s an estimated and simplified P&L to understand the tour economics at a high level:

Paying the Cowboy Carter Tour Performers: Dancers, Musicians, Her Man, and Her Children

According to published reports, Beyoncé pays her dancers approximately $2,500 per show. Multiply that by 32 shows, and each dancer would gross approximately $80,000 before per diems or other stipends. Most dancers are classified as independent contractors (1099 workers), not employees, meaning they’re responsible for:

Making their quarterly estimated tax payments

Managing their own write-offs (travel, meals, costuming, training)

Possibly creating an LLC or S-Corp for optimal tax positioning

Blue Ivy and Rumi Carter: The Cowboy Carter Tour Sweethearts

Beyoncé’s children, Blue Ivy and Rumi, are included in payroll. Rumi Carter performed in select segments of the show, while Blue Ivy performed for a majority of most shows. Blue Ivy and Rumi Carter’s appearances during Beyoncé’s Renaissance and Cowboy Carter tours were mother/daughter moments, but also compensated performances with real tax implications. The Carter children would likely be compensated through a structured entity (e.g. a trust or custodial LLC) to take advantage of income-shifting and family tax planning opportunities. It’s not uncommon for high-net-worth families to legally pay their children through company payroll to reduce overall tax liability.

When a minor child performs on stage, even for a parent’s tour, they must be paid according to industry standards, which typically means issuing a 1099 or setting up a child performer payroll arrangement through a loan-out company or trust. Depending on how Parkwood Entertainment structures those payments, Blue Ivy and Rumi’s incomes could be routed into a Coogan Trust or other protected financial vehicle, shielding it from misuse while still enabling long-term wealth building. Parents must also stay compliant with child labor laws and state-by-state performance regulations, especially when touring across multiple jurisdictions.

Jay-Z’s Appearances: Guest Verses, Not Free Features

Jay-Z has appeared at select Cowboy Carter shows including Paris, Los Angeles, and Atlanta, sparking fan frenzy and adding star power to an already iconic tour. But from a financial perspective, even a brief on-stage appearance by an artist of his caliber has accounting consequences. Whether compensated or considered a contribution under shared business entities (e.g., Roc Nation or related partnerships), Jay-Z’s participation may trigger income recognition, licensing rights, or even backend royalty arrangements depending on the show’s recording and monetization plans. When both spouses are powerhouses with separate entertainment businesses, intra-family transactions must be clearly documented, priced at arm’s length, and reported correctly to withstand IRS scrutiny.

Destiny’s Child Reunion: A Welcome Surprise in Las Vegas

Beyoncé did not let the Cowboy Carter Tour close without a moment of cultural and historical weight. During the final tour stop in Las Vegas, fans were electrified when Kelly Rowland and Michelle Williams joined her onstage for a Destiny’s Child reunion. The trio performed a medley of hits that paid tribute to their legacy while subtly reinforcing the power of catalog monetization, group trademarks, and performance royalties. From a business perspective, guest appearances like this often involve performance agreements or royalty splits, especially when the music performed is owned by multiple parties or licensing entities.

When Beyoncé, Kelly, and Michelle perform Destiny’s Child songs together on stage, especially if that performance is filmed, recorded, or later used in content (e.g. Netflix, YouTube, promo materials, or tour DVDs), it may trigger royalty or rights issues related to the original recordings and songwriting credits. These issues include:

Performance royalties split between members

Sync licensing fees if the footage is reused commercially

Mechanical royalties for replays or resales (digital or physical)

Group entity profit-sharing agreements (if Destiny’s Child still exists as a legal entity)

Shaboozey Takes the Cowboy Carter Stage: A First-Time Live Collaboration

Saturday night also marked the live debut of “Sweet Honey Buckin’” as Shaboozey joined Beyoncé on stage for a collaborative performance that fans had only seen digitally until now. As the only featured artist on the Cowboy Carter album to perform live during the tour, his appearance carries backend implications. Live guest features like Shaboozey’s typically involve negotiated appearance fees and may require synchronization licenses if the performance is recorded and used in commercial content such as tour documentaries or streaming specials. Live duet performances also open opportunities for cross-platform licensing, social media monetization, and performance rights payouts, all of which fall under the watchful eye of accountants, legal teams, and business managers.

Flying Private, Living Local

When Beyoncé performs in a city like Atlanta or Los Angeles, she and her family likely stay in one of several privately owned homes. If a personal home is used during a tour stop for "ordinary and necessary" expenses to host rehearsals, house glam teams, or serve as the staging point for transportation and logistics, then part of the expenses may be deductible if properly documented and substantiated. Expenses could include:

Utilities

Security costs

Catering or on-site chef services

Housekeeping during tour dates

Transportation staging (e.g., SUV rentals arriving from the property)

For her tour team: dancers, techs, makeup artists, security, and more, require logistics support at scale. That could mean:

Renting out full hotel floors or boutique properties

Hiring local chefs or catering teams post-show

Using a fleet of black SUVs or Escalades, often secured through a travel concierge or event logistics firm

Booking private airport arrivals into FBO terminals in cities like Austell or DeKalb-Peachtree for discretion and convenience

If Beyoncé’s management team charged Parkwood Entertainment for the use of a residence - whether as a host venue or rehearsal base, that charge must be supported by a formal agreement, priced at fair market value, and included in the entity’s ledger. It may also trigger self-rental rules or require passive activity disclosures depending on the structure.

Entity Structure and Taxes

At the center of it all is Beyoncé’s company, Parkwood Entertainment. The promoter (e.g. Live Nation) pays Parkwood directly. Parkwood then handles:

Artist payment

Contractor fees

Vendor and supplier invoices

Payroll for dancers, band members, stylists

Tax withholdings and filings

Reporting and compliance

Taxes are far from simple. With 30+ shows in different states and countries, Beyoncé’s team must manage multi-jurisdictional tax filings, including:

How the Numbers Stack Up: Cowboy Carter vs. Renaissance vs. The Greats

Different eras, different currencies, but the takeaway is clear: Beyoncé is setting records in real dollars, on her own terms.

Tour | Gross Revenue | Shows | Avg Gross/Show |

Cowboy Carter (2024–2025) | $400M | 32 | ~$12.5M |

Renaissance (2023) | $579M | 56 | ~$10.3M |

Michael Jackson (HIStory) | $165M | 82 | ~$2.0M |

Garth Brooks (1996–1998) | $105M | 220 | ~$0.5M |

The Cowboy Carter Tour: A Meticulously Sophisticated Operation

From tour routing to tax withholding, this is business at the highest level. The Cowboy Carter Tour is a financial case study. The numbers may headline, but the mastery lies in the strategy. Whether you're running a six-figure business or scaling to seven and eight, we make the money make sense. Beyoncé’s Cowboy Carter Tour shows what’s possible with the right structure.

The Winston CPA Group helps entertainers, entrepreneurs, and executives reduce taxes, clean up their books, and build wealth the right way. Whether you're paying dancers or paying yourself, it starts with a having a CPA on your team.

Get to know The Winston CPA Group and our commitment to supporting clients with accounting, tax, and strategic business planning at WinstonCPAGroup.com.

How much did Beyoncé make from the Cowboy Carter Tour?

Estimated net earnings are $55 million after production, payroll, taxes, and other costs.

Is Cowboy Carter the highest-grossing country tour ever?

Yes. Beyoncé holds the record as the highest-grossing artist in the genre.

Did Beyoncé’s children perform in the Cowboy Carter Tour?

Both Blue Ivy and Rumi Carter performed during select shows, and their involvement would be subject to minor performer labor laws and structured compensation.

How are Beyoncé's dancers paid?

Most dancers are estimated to earn $2,500 per show and classified as independent contractors (1099s).

What’s the tax impact of artists and 1099 freelancers performing in multiple states?

Beyoncé, her dancers, crew, and others are subject to the jock tax, which requires income reporting in each city and state they performed in.

How are artists like Beyoncé taxed on tour income?

Income is earned by the artist’s company (Parkwood Entertainment), taxed at the entity level, and then passed through depending on the corporate structure.

Can expenses like glam, lodging, and security be deducted on a business tax return?

Yes, if they’re ordinary and necessary for the tour. Travel, meals, glam teams, and security are deductible as business expenses when properly documented.

Disclaimer: The content on NikkWinstonCPA.com is for informational and educational purposes only and should not be considered professional tax, accounting, legal, or financial advice. While I am a licensed CPA, the information shared on this site does not create a client relationship, nor is it a substitute for personalized consultation based on your specific circumstances. Unless otherwise stated, all content reflects my professional opinion at the time of writing. NikkWinstonCPA.com and its affiliates are not responsible for any actions taken (or not taken) based on the information provided on this site. Every accounting & tax situation is different, and laws can vary by state and change over time. You should always consult directly with a qualified tax professional or CPA at The Winston CPA Group before making decisions related to your business, finances, or personal taxes.

Comments